Breaking: Full Charge In 5 Minutes Scalable Solid State Battery Unveiled At CES 2026

| Jerry Huang

News from Consumer Electronics Show (CES) 2026 in Las Vegas, a Finnish startup Donut Lab showcased their explosive "black tech" product at the annual CES exhibition - this company claims its battery to be the world's first mass-produced all-solid-state battery (ASSB).  At the 2026 CES exhibition, Donut Lab announced the launch of what it calls the world's first all-solid-state battery, which is ready for OEM production and will be the first type to be applied to Verge Motorcycles' TS Pro and Ultra, two wheeled motorcycle models. If they are truly delivered to customers, this will be an important milestone in the global electrification path, marking the transition of solid-state technology from the laboratory to mass production models.

At the 2026 CES exhibition, Donut Lab announced the launch of what it calls the world's first all-solid-state battery, which is ready for OEM production and will be the first type to be applied to Verge Motorcycles' TS Pro and Ultra, two wheeled motorcycle models. If they are truly delivered to customers, this will be an important milestone in the global electrification path, marking the transition of solid-state technology from the laboratory to mass production models.  In a press release on its official website, Donut Lab stated that it is committed to innovating and delivering new forms of electrification solutions by pushing unceasingly the limits of electric vehicles’ performance and bringing new technology to the market. Donut Lab is shaping the future of mobility. "Now, Donut Lab is honored to launch the world's first all solid state battery that can be used for OEM vehicle manufacturing. The Donut Lab solid-state battery will be immediately put into commercial application, providing power for the existing lineup of Verge motorcycles.”

In a press release on its official website, Donut Lab stated that it is committed to innovating and delivering new forms of electrification solutions by pushing unceasingly the limits of electric vehicles’ performance and bringing new technology to the market. Donut Lab is shaping the future of mobility. "Now, Donut Lab is honored to launch the world's first all solid state battery that can be used for OEM vehicle manufacturing. The Donut Lab solid-state battery will be immediately put into commercial application, providing power for the existing lineup of Verge motorcycles.”

According to reports, Donut Lab's all-solid-state battery provides an energy density of 400Wh/kg, enabling longer range, lighter structure, and unprecedented flexibility in vehicle and product design.

The battery can be fully charged in just 5 minutes without the need to limit charging to 80%, and it supports safe, repetitive, and reliable full discharge.

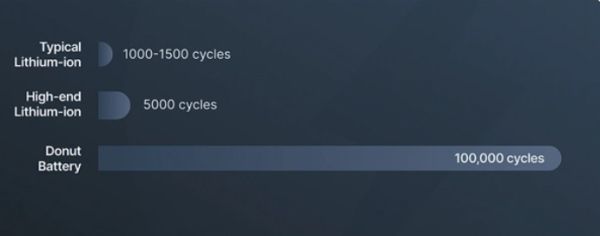

Unlike traditional lithium-ion batteries, this all-solid-state battery offers “minimal capacity fade” over its lifetime. It is claimed to have tested up to 100,000 charge cycles, providing an actual lifespan far beyond existing technologies. Safety is another core of its features: no flammable liquid electrolytes, no thermal runaway and no metal dendrites! This fundamentally eliminates the cause of battery fires, making it extremely safe and truly revolutionary.  Donut Lab stated that the performance of the battery has been rigorously tested in temperatures ranging from -30 to over 100 degrees C (retaining 99 percent capacity “with no signs of ignition or degradation”).

Donut Lab stated that the performance of the battery has been rigorously tested in temperatures ranging from -30 to over 100 degrees C (retaining 99 percent capacity “with no signs of ignition or degradation”).

In terms of raw materials and costs, Donut Lab states that its solid-state batteries are entirely made from “abundant, affordable and geopolitically safe materials”, free of rare elements, cost less than lithium-ion alternatives. However, Donut Lab does not specify the specific materials required to produce their all-solid-state battery cell.

Antuan Goodwin, a senior automotive industry journalist, has had a close encounter with Donut Lab's all solid-state battery model at this year's CES exhibition. According to his introduction, this battery size is similar to a large screen smartphone (such as the iPhone 17 Pro Max), and it is extremely lightweight. This ultra light battery will also be very suitable for application in drones in the future.

According to its plan, Donut Lab is to build a solution to combine these batteries into larger 5 kWh power units; and each unit is of similar size to the PS5 gaming console. Its small size will allow an installation of four such power units into the frame of the Verge TS Pro motorcycle. This breakthrough design benefits from a circular electric motor integrated in the wheel announced by Donut Lab last year.  Donut Lab and Verge Motorcycles announced on Monday that Verge motorcycles will be the world's first mass-produced vehicle equipped with this new battery. The motorcycle features a charging time of only 10 minutes, providing a comprehensive range of up to 60 kilometers per minute of charging. And their version Verge Ultra can travel up to 600 kilometers on a single charge. A 100,000 cycle life of this battery can be interpreted to a theoretical total range of 60 million kilometers. Even if it is driven 60000 kilometers per year, this battery can theoretically last for 1000 years. Some say, this sounds “too good to be true.”

Donut Lab and Verge Motorcycles announced on Monday that Verge motorcycles will be the world's first mass-produced vehicle equipped with this new battery. The motorcycle features a charging time of only 10 minutes, providing a comprehensive range of up to 60 kilometers per minute of charging. And their version Verge Ultra can travel up to 600 kilometers on a single charge. A 100,000 cycle life of this battery can be interpreted to a theoretical total range of 60 million kilometers. Even if it is driven 60000 kilometers per year, this battery can theoretically last for 1000 years. Some say, this sounds “too good to be true.”

“Donut Lab has engineered a new high performance solid state Donut Battery that can be scaled to major production volumes and seen now in real world use in the Verge Motorcycles bikes out on the road in Q1 2026.” The price for Verge TS Pro starts from $29900.  Besides the installation in electric motorcycles, solid-state battery is obviously more promising in the application of electric vehicles. Goodwin stated that the advantages of this technology are more significant in large vehicles - the weight reduction and charging speed improvement will show a doubling effect in use. Donut Lab announced on Monday that it will collaborate with electric vehicle company WattEV to create an ultra lightweight modular electric vehicle platform that combines Donut motor and battery technology.

Besides the installation in electric motorcycles, solid-state battery is obviously more promising in the application of electric vehicles. Goodwin stated that the advantages of this technology are more significant in large vehicles - the weight reduction and charging speed improvement will show a doubling effect in use. Donut Lab announced on Monday that it will collaborate with electric vehicle company WattEV to create an ultra lightweight modular electric vehicle platform that combines Donut motor and battery technology.

"Solid-state batteries have always been described as ‘just a few years away,'" Donut Lab chief executive Marko Lehtimäki said. "Our answer is different. They're ready today. Not later."

For better understanding, let's take a look at the current batteries in commercial use and plans for mass production of their all-solid-state batteries. There has always been the "(Mundellian) Trilemma" or "The Impossible Trinity" in the battery industry, which refers to the difficulty of simultaneously balancing the three core indicators of batteries (performance, cost and safety). Optimizing one of them often requires sacrificing the other or even two.

In comparison, the energy density of top commercial lithium-ion batteries ranges from approximately 250 to 300 Wh/kg, with a typical lifespan of around 5000 cycles. To extend battery life, it is often not recommended to charge them higher than 80%. If all features of Donut battery are true, it basically surpasses existing technology in every dimension.

Sunwoda announced in October 2025 a new generation polymer solid-state battery with an energy density of 400Wh/kg, which has a lifespan of only 1200 cycles; The second-generation Shenxing super battery released by CATL in April 2025 has also been commercialized with a range of 520 kilometers in 5-minute charging. The cycle life of its fifth generation LFP battery is approximately over 3000 cycles.

Toyota initially planned for mass production of its all-solid-state battery in 2020, but later it was postponed to 2023 and then to 2026, now 2027-2028. Samsung SDI has also set its goal of scalable all-solid-state battery in 2027.

CATL has a plan that their small-scale production of all-solid-state battery will be carried out in 2027 and large-scale in around 2030. Hyundai and Kia say that it will not be earlier than 2030. Bloomberg NEF predicts that even by 2035, all solid state batteries will only enjoy about 10% of global share from electric vehicles and energy storage installations.