Will the lithium hexafluorophosphate (LiPF6) market boom or crash in 2021?

| Jerry Huang

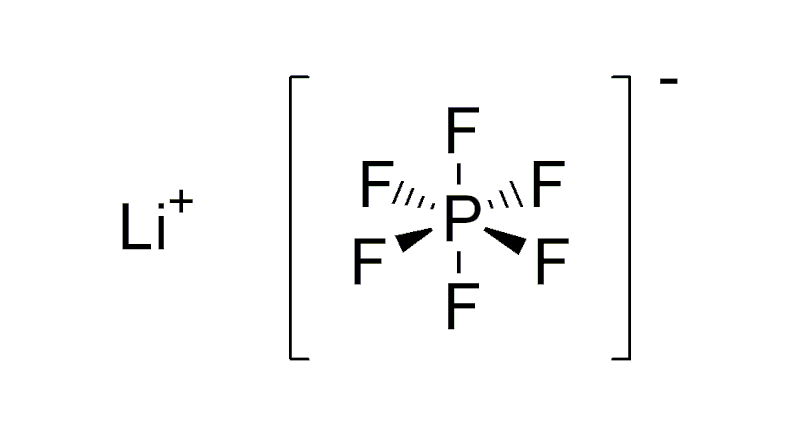

Lithium hexafluorophosphate (LiPF6) is a key raw material in today's technology, for lithium-ion battery electrolytes of lithium-ion power batteries, lithium-ion energy storage batteries and other consumer electronics' li-ion batteries. Along with the boom of EV industry, the li-ion power battery segment consumes the largest portion of LiPF6 in the market.

Since September 2020, the sales of new energy vehicles have increased substantially, which has driven the sales of lithium hexafluorophosphate to increase. It is estimated that the lithium hexafluorophosphate demand in the power battery segment will be about 66,000 tons in 2021 and about 238,000 tons in 2025, with an average annual growth rate of about 40%.

According to data from January to September 2021, China's accumulative capacity of LFP battery in EV installation is about 45.38GWh, and the accumulative capacity of ternary batteries is about 49.70GWh. It is expected that the annual total capacity of LFP battery in EV installation will exceed that of ternary in 2021, with high year-on-year growth rate expected.

As of October 18, the price of lithium hexafluorophosphate was 520,000 yuan/ton, and it has risen by nearly 500% in 2021 with its price at 107,000 yuan/ton only at the beginning of this year, setting a new record high since June 2017. Lithium hexafluorophosphate and electrolyte additives have clearly become one of the materials with the highest growth rates this year. The strong demand in the market is expected to continue, and it is currently in short supply.